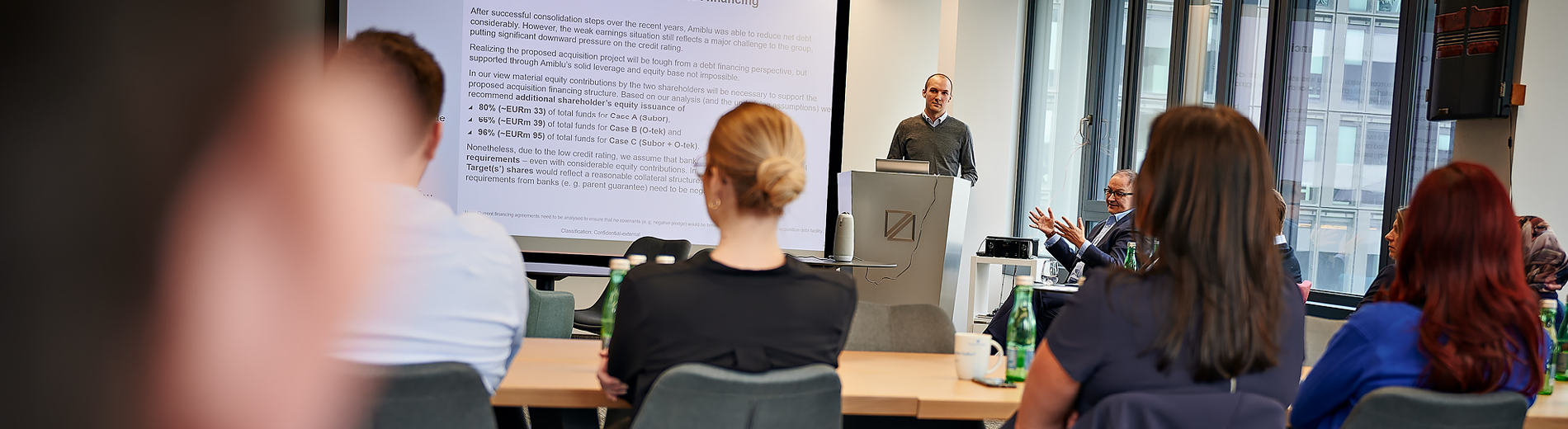

Basic training course: Treasury Management

Comprehensive, practical basic training for day-to-day treasury work

Cash management module

06.10. - 10.10.2025 ONLINE

Financing module

22.09. - 26.09.2025 in Cologne

Risk Management Module

10.11. - 14.11.2025 in Vienna

Basics

5 days

all modules (discount 15%)

EUR 8.542,- plus VAT

per module

EUR 3.350,- plus VAT

Content

More than 1,300 participants have already attended the "Fundamentals of Treasury Management (GTM)" course and acquired the necessary tools for their day-to-day work in corporate treasury management. The content of the course was compiled on the basis of our experience from over 5,000 consulting projects at more than 2,000 companies and is constantly being further developed.

Based on the transfer of the necessary theoretical knowledge, the course is geared towards the following, practice-oriented objectives:

- Designing processes securely and efficiently

- Recognize and realize potentials

- Identify and manage risks

The course consists of three modules of one week each, which you can also book independently of each other. Since the modules complement each other and do not build on each other, it is also possible to choose the order and venues as desired.

Optionally, an examination can be taken afterwards to confirm the learning success and to document the acquired qualification(treasury certification).

Main topics

Basics

- What are the tasks of the cash manager in the company?

- What are the minimum standards to be taken into account in the organizational structure & process organization?

- What are the differences in the accounting or treasury perspective? Which business management approaches do you need to understand?

- What are the requirements vis-à-vis banks?

- What are the current trends in cash management for large and small companies?

Cash management module

- Treasury Organization

- Cash and liquidity management

- Payment transactions

- Working Capital Management

- Macroeconomics and financial markets

- Financial mathematics and interest calculation

Financing module

- Liquidity planning: simple, system-supported, future-proof

- Financial strategy, rating and credit agreements

- Bank financing

- Export financing

- Capital market financing: bonds, shares

- Portfolio management for investors and debtors

Risk Management Module

- Currency Risk Management

- Interest rate risk management

- Treasury in practice

- Hedge Accounting and Accounting for Treasurers

- Final case study

Group of participants

Employees and junior managers from the areas of treasury, finance, controlling or accounting who are looking for comprehensive, practical basic training for their day-to-day work in treasury and finance management, as well as corporate account managers from banks who want to get to know the day-to-day business of their customers from their perspective

Speakers

The team of speakers consists of partners and consultants from SLG on the one hand and experts from companies and banks on the other.